Loan Ontario: Checking Out the Range of Loaning Options

Loan Ontario: Checking Out the Range of Loaning Options

Blog Article

Unlock Your Financial Potential With Easy Lending Providers You Can Trust

In the world of personal financing, the availability of hassle-free finance solutions can be a game-changer for individuals making every effort to open their monetary potential. As we discover the world of problem-free fundings and trusted services additionally, we discover important insights that can equip individuals to make enlightened choices and secure a secure monetary future.

Benefits of Hassle-Free Loans

Hassle-free financings use customers a reliable and streamlined means to gain access to financial support without unnecessary complications or hold-ups. One of the main advantages of easy car loans is the fast approval procedure. Traditional fundings commonly entail prolonged paperwork and authorization durations, causing hold-ups for people in urgent requirement of funds. In contrast, easy lendings focus on rate and benefit, supplying borrowers with fast accessibility to the cash they need. This expedited procedure can be particularly helpful throughout emergency situations or unexpected monetary scenarios.

Furthermore, problem-free lendings commonly have minimal eligibility requirements, making them obtainable to a broader series of people. Traditional lenders typically need substantial paperwork, high credit rating, or collateral, which can exclude several possible consumers. Easy financings, on the various other hand, concentrate on affordability and flexibility, supplying aid to people who may not meet the rigorous needs of standard banks.

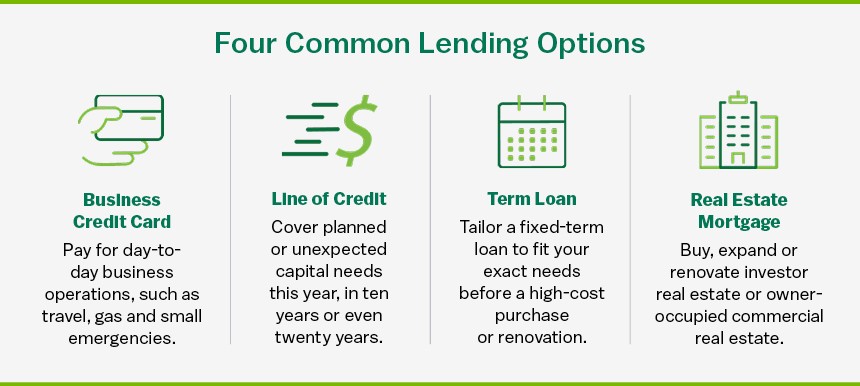

Kinds Of Trustworthy Lending Provider

How to Get approved for a Finance

Discovering the crucial eligibility criteria is essential for individuals looking for to receive a car loan in today's financial landscape. Lenders generally assess several factors when figuring out a debtor's eligibility for a finance. One of the key considerations is the candidate's credit rating. A great credit rating indicates a background of accountable economic habits, making the consumer much less high-risk in the eyes of the loan provider. Income and employment standing likewise play a substantial function in the car loan authorization process (personal loans ontario). Lenders require assurance that the debtor has a stable earnings to settle the loan on schedule. In addition, the debt-to-income proportion is a vital statistics that lenders make use of to evaluate an individual's capability to handle extra debt. Providing accurate and updated economic info, such as tax returns and financial institution statements, is crucial when requesting a financing. By understanding and satisfying these eligibility standards, people can improve their chances of getting a finance and accessing the economic assistance they need.

Taking Care Of Financing Repayments Wisely

When borrowers effectively safeguard a funding by fulfilling the crucial eligibility requirements, prudent administration of funding payments becomes critical for keeping monetary stability and credit reliability. Prompt repayment is crucial to stay clear of late charges, penalties, and adverse effects on credit history. To manage financing payments wisely, borrowers must create a spending plan that includes the month-to-month repayment quantity. Establishing automated payments can assist ensure that repayments are made on schedule every month. Additionally, it's a good idea to prioritize finance repayments to prevent dropping behind. In cases of monetary troubles, communicating with the loan provider proactively can sometimes result in different settlement setups. Keeping track of credit rating reports regularly can likewise aid consumers stay informed regarding their credit scores standing and determine any kind of discrepancies that may need to be resolved. By taking care of funding settlements responsibly, customers can not only meet their economic commitments yet also build a positive credit report that can benefit them in future monetary ventures.

Tips for Choosing the Right Financing Alternative

Choosing the most ideal funding choice entails detailed research study and consideration of specific monetary demands and scenarios. To begin, analyze your monetary scenario, including revenue, costs, credit report, and existing financial obligations. Recognizing these aspects will certainly assist you establish the type and amount of loan you can pay for. Next off, compare finance alternatives from various loan providers, consisting of conventional financial institutions, debt unions, and online loan providers, to locate the very best terms and Website rate of interest. Consider the loan's total price, settlement terms, and any kind try this web-site of added costs connected with the car loan.

In addition, it's vital to choose a financing that lines up with your economic goals. By complying with these tips, you can with confidence choose the ideal lending alternative that helps you accomplish your monetary purposes.

Final Thought

In conclusion, unlocking your economic possibility with convenient loan solutions that you can rely on is a responsible and clever choice. By understanding the advantages of these financings, recognizing exactly how to get them, managing settlements sensibly, and choosing the appropriate financing alternative, you can accomplish your financial objectives with confidence and comfort. Trustworthy finance services can give the assistance you need to take control of your funds and reach your preferred end results.

Protected lendings, such as home equity finances or automobile title loans, enable consumers this post to utilize security to safeguard lower rate of interest rates, making them an ideal selection for individuals with useful properties.When borrowers effectively safeguard a lending by satisfying the key qualification criteria, prudent administration of lending payments comes to be paramount for maintaining monetary stability and credit reliability. By taking care of loan repayments properly, debtors can not just meet their economic commitments yet also build a positive credit score background that can profit them in future economic undertakings.

Take into consideration the finance's total cost, repayment terms, and any added costs linked with the financing.

Report this page